Ucreative’S Big Listing Of Freelancer Tax Deductibles

Don’t forget these deductibles on your adjacent income taxation render.

After doing a individual poll of freelancers as well as contractors, we were surprised to observe out that a lot of sole proprietors were unaware that you lot had to pay your IRS dues quarterly – amidst several other things. Even more than surprising was how many didn’t know which purchases they could really could count equally deductibles against their estimated quarterly taxes.

H5N1 primal job is that if yous don’t claim enough deductions, it mightiness simply not be worth the problem. While it mightiness appear airheaded to keep tabs on every picayune deductible expense, it actually tin all add up.

The cardinal is to accept a skillful recording organization set. While you tin go alongside any system y'all’d similar, they should e'er betoken the purpose of the purchase too as who yous paid for it.

The IRS has 5 categories for deductibles:

- Gear together with Equipment

- Research too Education

- Meals as well as Entertainment

- Travel

- Necessary as well as Ordinary Business Expenses

“Ordinary too Necessary…”

…is the full general rule amongst which the IRS judges a purchase not clearly in whatever of the other categories to be deductible or non. And it’s where y'all become to live a niggling more than creative.

What’s “ordinary and necessary” will naturally differ depending on your industry. An entertainer for example, will live able to claim deductions for things a security contractor tin’t- as well as vice-versa.

As yous’d wait, there are plenty of exceptions as well as it would be impractical to boom them all down in ane weblog mail.

Here we’ve tried to list downward as many items the IRS allows freelancers to list every bit a taxation deductions — in even more than categories. While that may look to be needlessly complicated, we experience that these are cardinal areas freelancers ofttimes forget to await at when listing deductions.

There will be plenty of overlaps, inwards the advert of presenting all this in an slow-to-empathize slice. If nosotros’ve missed anything of import, let us know inwards the comments!

UCreative’sec Big List of Freelancer Tax Deductibles

Capital Expense Deductions

- Essential equipment

- Vehicles

- Real property

- Amortization costs

- Depreciation costs

Note: Capital expenses are expenditures for fixed assets – items with a usable life extending beyond the taxable twelvemonth.

Business Incorporation Costs

- annual state fees

- legal fees

- whatever reasonable costs associated alongside starting a business concern

- Self-exercise Tax — You can deduct upward to l% of the self-usage taxation.

Home Office Expenses/Improvements

- Furniture as well as fixtures

- Professional fees

Note: Just brand sure it’second straight connected to operate. It’ll be more than reasonable to an auditor if y'all bought the items afterwards starting/incorporating your business.

Equipment/Toolkit Items

- EVERY. SINGLE. TOOL. Whether it’s a spatula or a thumb tack, if it was bought for business role, deduct it.

- Office piece of furniture

- Computers

- Cameras. Need a camera to take pictures for your website or food truck menu? Deduct it.

- Hard disks in addition to flash drives

- Cleaning accessories

- All devices intended for business organisation role

- Technical support service fees for all of these

Repairs

- Materials

- Professional fees

Consumables

- Prepaid call up credits

- Toiletries

- Sundry office supplies— anything that gets expended over fourth dimension

- Fuel. You tin only deduct mileage for travel out of your local area . The distance given is nominally 50 miles, though in that location may live exceptions. You can either calculate based on mileage driven or gas station receipts.

Travel

- Plane tickets

- Cab fare

- Hotel accommodations

Note: Make certain these things are all straight related to your concern. Commuting within 50 miles of where you lot live is NOT deductible.

Promotions

- Business cards

- Flyers

- Online ads

- Banners

- TV and Radio advertisements

- Website hosting

- Website domain

- Promotions Development Expenses

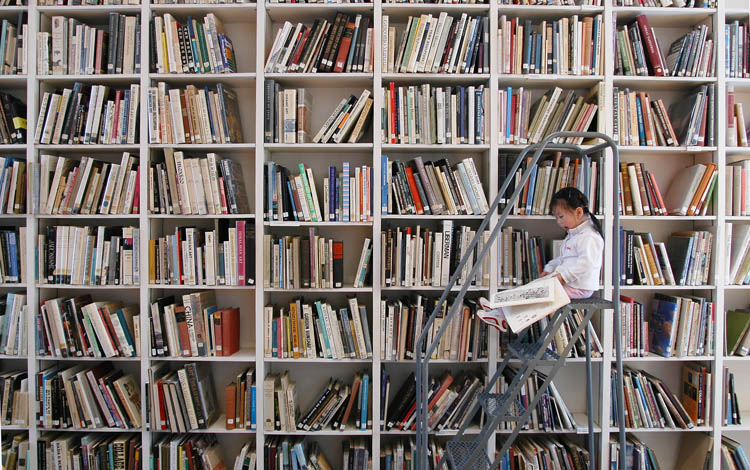

Education & Research

- Education in addition to higher-learning expenses

- Textbooks

- Industry-related magazines in addition to other periodicals.

- A business-related internet connectedness

- Paid Internet subscriptions to relevant sites

- Hulu, Netflix, etc. if it’second necessary for your occupation of work. Artists too designers for case, can claim subscriptions to these as necessary.

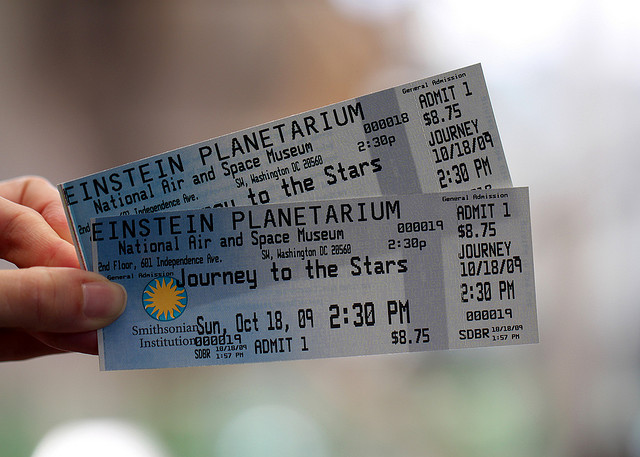

Meals, Drinks, in addition to Entertainment.

- If you lot throw a political party, or buy film or house tickets to entertain clients expenses are deductible up to fifty%. You could too claim the same 50% for activities leading upwardly to a come across alongside a customer. If y'all notice yourself working inwards coffee shops a lot, this mightiness live pretty of import.

- Parties alongside colleagues after wrapping upwardly projects can be deducted completely, especially if they are expected inward your industry.

Note: These expenses have to live “reasonable”, which is a fairly subjective term.

Losses Due To:

- Theft

- Uncollectible accounts

- Natural disasters

Work-related Clothing

- Safety wearable

- Performance-related attire (something you lot would wear onstage, but not commonly on the street)

- Tailoring together with maintenance costs

Note: Some items that do non qualify: dress shirts, bibs, overalls — fifty-fifty if required onsite. If it’second something that yous could live expected to vesture for personal reasons, chances are yous tin’t claim a deduction for it.

Trade Convention Fees

- Registration expenses

- Submission costs (if applicable)

- Refer to the function on Travel

Health Insurance Costs

Only applies if you pay for it yourself together with if the costs are higher than 7.v% of your adjusted gross income.

Note: Not applicable for insurance through a marriage membership

Interest On:

- Credit cards (for business concern expenses, of class)

- Business loans

Professional Fees

- Legal fees

- Contractor’s fees

- Tax grooming.

Utilities

- Rent/lease

- Heating

- Electricity

- Internet

- Phone

Note: If y'all’re working from a habitation function, exclusively a constituent of these expenses tin live deducted, inside argue. You also cannot deduct expenses for telephone lines that already existed inward your home before yous ready your home role. However, y'all tin can completely deduct expenses from subsequent lines.

Apps.

- Paid spider web services (such every bit job search and staffing sites)

- Purchase of software related to your manufacture

- Skype

- Paypal

Payments to Non-profits

- Costs to attend networking events held by a not-profits (1.e. a church, The Red Cross, etc.)

- Using services given past a not-profits (i.e. buying advertizing infinite etc)

Union/Association Dues

- Boards of trade

- Business leagues

- Chambers of commerce

- Civic or world service organizations

- Professional organizations such every bit bar associations too medical associations

- Real estate boards

- Trade associations

What You May Not Deduct

- hobby clubs or groups,

- land clubs

- recreation

- social groups

Subcontractors as well as other Freelancers

Note: Be sure to follow country as well as Federal tax laws on their compensation.

Influenza A virus subtype H5N1 Word of Warning!

Not all these options volition live available to all freelancers. There’s a argue why in that location are lawyers and accountants who specialize inwards this sort of matter – it’s impossible to hand everyone the same tax advice.

Check out the IRS’sec sole proprietorship forms page to figure out what you’ll involve to fill up out. Next, mouth amongst a qualified professional earlier deciding on what your business’s tax strategy should live.

Don’t forget to ask for a receipt.

Sources too Additional Reading

concern.tutsplus.com – 10 Deductions- Freelancers Can Grab

mashable.com – self-employed-revenue enhancement-deductions

biztaxlaw.well-nigh.com

nolo.com legal-encyclopedia – How Sole Proprietors Are Taxed

sba.gov – Business Structure as well as Tax Implications

smallbusiness.chron.com – Deductible Expenses Sole Proprietorship

Image Credits

Dave Dugdale via photopin cc

Mr. T inward DC via photopin cc

1lenore via photopin cc

kchbrown via photopin cc

Ozyman via photopin cc

Images_of_Money via photopin cc

sean dreilinger via photopin cc

atmtx via photopin cc

Komentar

Posting Komentar